Introduction Mysst?

MySST Online can be used to file and pay the Sales and Service Tax. You can get to it whenever and wherever you want.

The system can be used with Internet Explorer 11.0 or higher, the latest version of Chrome, or a screen resolution of 1024 x 768 or higher. If your browser is not compatible with this system, it may not look right on your screen. At this time, we suggest that you update your browser.

Please send an email to [email protected] if you have any problems with the way this system or website works. Send an email to [email protected] if you find any broken links or mistakes in the text, or if you have any other comments or ideas about how to make this site better.

About Mysst?

Service tax is a tax that is charged and taken from any taxable person in Malaysia who provides taxable services in the course of business.

Taxable person is anyone who lives in Malaysia and is told they are taxable. Taxable service is any service that the government says is taxable.

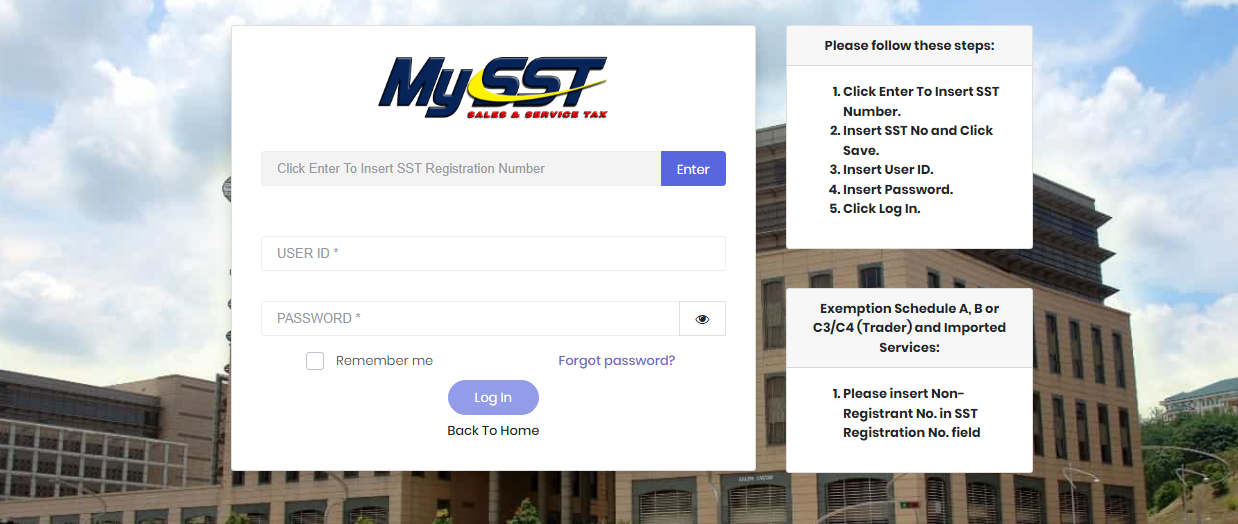

How To Logjn Mysst?

Step 1: Open a web browser and type in the Mysst login URL.

Step 2: Type your “User Id” and “Password” into the fields provided.

Step 3: Click the button that says “Login.”

How To Forget Password Mysst?

Step 1: Type “Reset Mysst password URL” into a web browser to open the page.

Step 2: Type your “Email Address” into the field that says “Email Address.”

Step 3: Click “Submit.” The system will check your information and send you a link to reset your password to the email address you used to sign up. Go to your email and click on the link to see what to do to finish the process.

Go to the login page and enter a new password to get into your

Mysst Portal

The Sales and Service Tax took the place of the Goods and Services Tax (GST) in Malaysia on September 1, 2018. The GST had been in place for three years (SST). If you own a small business in Malaysia, you can find all the information you need here to follow the country’s Sales and Service Tax rules.

There are some big differences between SST and GST, but there are also many similarities. Even though they are similar, there is one important difference: more goods and services are exempt from sales and service tax (SST) than from GST.

Mysst Guide

Only things that are made or brought into Malaysia are taxed.

There will be no sales tax on things made in the U.S. that are sent abroad.

There is a sales tax of either 5% or 10%, or a fixed rate, or there is no sales tax at all. On the other hand, you don’t have to put a tax on everything. This is why, unless it says otherwise, a sales tax must be added to all purchases.

The Sales Tax is a “monofilament” tax, which means that it is only charged once, either when goods are imported or when they are made.

Only manufacturers who got paid for their raw materials, parts, and packaging will not have to follow this rule.

Related Keyword

- mysst cannot login

- mysst payment

- mysst registration

FAQs

Who Should Pay SST Malaysia?

Who in Malaysia pays SST (Sales and Service Tax)? Businesses that do business in Malaysia and around the world will have to pay SST if their annual income is more than a certain amount. At the moment, the threshold is set at RM500,000.

How Do I Submit My Service Tax To Mysst?

You must send in your Tax Return electronically through https://mysst.customs.gov.my/. After you send in your return, you can make payments through FPX in the same portal. There are 17 banks to choose from.

How Do I Pay Mysst?

Taxes can be paid either electronically through the MySST system (Financial Process Exchange, or FPX), or by hand with a check or bank draft. Online, you can only pay the full amount. There is no way to pay in cash.

What Is SST Registration Number?

The SST number is a unique number that is given to every business that is registered in Malaysia. If I don’t have a tax ID number, what will happen? Wix will charge SST and get it in return.

@VariateEcamz @Banks @BYPASSlNG @ExodeTeam Not gonna tattoo if I get botted subs so no point really hah

— Teeqo (@Teeqo) December 20, 2014